Innovating Your Ideas into Digital Success

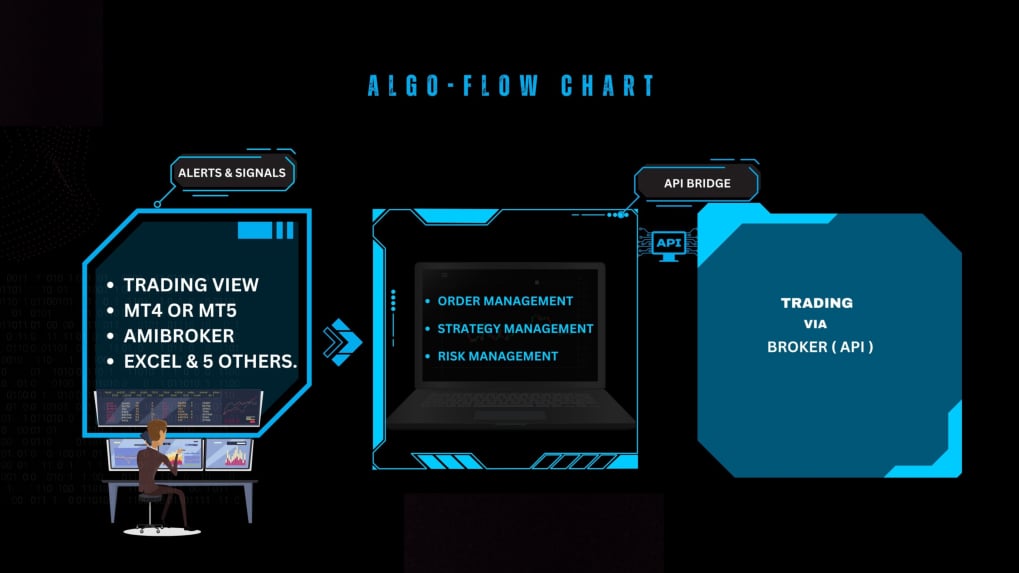

We specialize in Digital Marketing, Web Design & Development, Mobile App Development, Graphic & Video Design, and API-based Trading Bridge Software. At the core of our work lies a passion for redefining industry standards. Our success stems from an unwavering focus on client satisfaction—seamlessly combining creativity with technical precision to deliver tailor-made, impactful solutions.

Best Features

Automatic MIS order place with proper trailing stop loss (Intraday Only).

Leverage Strategy Platforms Integrate with 10+ Platform Like TradingView, MT4, MT5

Trade only happen when Trader login in our web portal & Broker account.

We develop your strategy with our code.

API bridges play a vital role in connecting algorithmic trading software with the trading infrastructure, allowing for automated trading, real-time data analysis, and efficient execution of trading strategies. They enhance the speed, accuracy, and reliability of trading operations, enabling traders to take advantage of market opportunities effectively.

Algorithmic trading, also known as algo trading or automated trading, is a method of executing trades in financial markets using computer algorithms. It involves the use of pre-defined sets of rules and instructions to automatically place trades, manage positions, and execute orders without the need for human intervention.

Auto buy and sell signals in the share market refer to automated notifications or indications generated by trading systems or algorithms that suggest when to buy or sell a particular stock or security. These signals are based on predefined rules and technical indicators programmed into the trading system.

MT4 and MT5 indicators, Master Advisors, Calculators, and even Money Management formulas are the main Trading tools. Most of these tools are special indicators. These tools have one main objective, to assist brokers with estimating future value changes. We at Rich way with a group of expert MT4/MT5 software engineers to build up your trading strategy

✔️ Expertise That Matters

✔️ Tailor-Made Solutions

✔️AI-Driven Efficiency

✔️End-to-End Support

✔️Proven Track Record

Algo trading executes trades in milliseconds, far faster than human traders, allowing you to capitalize on market opportunities instantly.

Algo trading can optimize the timing of trades, minimizing market impact and reducing overall transaction costs.

Algorithms follow predefined strategies, eliminating emotional biases and impulsive decisions, resulting in more disciplined and consistent trading.

Algorithms can handle trading across various asset classes (stocks, forex, commodities) simultaneously, ensuring diversified portfolios.

Built-in risk management controls (e.g., stop-loss orders) can be integrated into algorithms to limit losses and protect your portfolio.

You can test your trading strategies on historical market data, optimizing them for maximum effectiveness before going live.

| Difference's | Manual Trading | Algo Trading |

|---|---|---|

| Fast Trading | ||

| Strategic Risk Management | ||

| Emotionless Trading | ||

| Fully Automatic Strategies | ||

| Over Trading | ||

| Human Error | ||

| Emotions Conflict | ||

| Trade Entry & Exit Confusion |

Our Support Team Always Ready To Help You.

Trades executed at the best possible price.

Fully Automated Mechanical Functionally.

Algorithmic trading, or algo trading, uses pre-programmed instructions (algorithms) to execute trades automatically based on defined criteria like price, timing, or volume. It minimizes human intervention and allows for faster, more efficient trading.

Algo trading offers several advantages, including speed, accuracy, reduced emotional bias, backtesting capabilities, and the ability to monitor multiple markets simultaneously.

Not necessarily. in our platforms offer user-friendly interfaces where strategies can be customized without coding. However, some advanced features may require programming knowledge.

Yes. with our webhook facility you to implement and test your custom strategies before running them live in the market.

Yes, algo trading is legal in India and widely used by institutional and retail traders. Also, SEBI opens algo trading for retail investors: New regulatory framework from Aug 1 and you can refer circular by visiting official SEBI website.

The capital requirement varies depending on your trading strategy and the market. with our platform you can to start with small amounts, especially in Nifty-50, Fin-Nifty and Bank Nifty.

WE ALWAYS TRY TO UNDERSTAND CUSTOMERS EXPECTATION

9:00 AM TO 9:00 PM

Home Branch : Dhanbad, JH, 826001

Technical Branch : Sector 18, Noida, 201301

care@nexgnalgo.com

+91 8595426573

Algotradify AI Solutions is a sophisticated Algotrading platform, uniquely integrated with TradingView and custom strategies, offering a seamless API connection to your broker. Tailored for retail traders and investors, our platform is dedicated to elevating wealth management practices. While we strive to ensure flawless operation, we recommend consulting a financial advisor before trading or investing through our platform. Please be aware that Algotradify AI Solutions cannot be held accountable for any losses resulting from market volatility or any platform-related issues.

Facebook

Instagram

Telegram

WhatsApp